Non-Real Work: Eliminating Private Health Insurers From Primary Coverage. Single Payer Time Has Come.

Posted on | April 26, 2017 | 2 Comments

Mike Magee

Economist Herbert Stein, WSJ contributor, AEI senior fellow, and economic advisor to Richard Nixon, famously said, “If something can not go on forever, it will stop.”

When it comes to the health insurance industry in America, we may be approaching that point. Obamacare, and those opposed to it, have managed in the heat of battle to accomplish what others have tried and failed to do over the past century.

As the Republican’s Freedom Caucus head fakes another run at ACA repeal, an overwhelming majority of Americans now believe that access to quality health care is a right rather than a privilege. And as we’ve seen in the past month, attempts to reintroduce regressive policies that would discriminate and target the most vulnerable in America have met a stiff public rebuke. It’s hard to turn back time when it comes to social policy, especially when income disparity has reached stratospheric levels.

The debate is beginning to shift from how do we get private insurers to participate to how do we move toward a single payer system. The public conversation is no longer either/or, but rather what kind of single payer. Should a state like California with its huge economy go it alone, with Medicare and Medicaid waivers from the federal government? Should we have “Medicare for All” as Bernie Sanders advocates? Or should we expand on the success of the Medicaid extensions featured under the ACA?

At the core of all these solutions is simplicity, cost and trust. On all three scales, health insurers, and their lobbyists, and state and federal government protectors have failed us. The only reason it has taken this long for us to look elsewhere is because the facts have been so well hidden within the cracks of the Medical Industrial Complex. Until now.

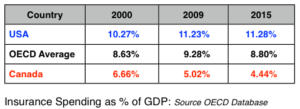

The U.S. insurance industry as a whole consumed 11.28% of our total GDP in 2015, roughly $2 trillion of our $18 trillion financial output. By comparison, Canada consumed only 4.4% of its’ GDP. Roughly 1/3 of the $2 trillion we spent went to Health Insurers. They function in a separate universe from Life Insurers and Property/Casualty Insurers who each consumed about 1/3 of the spend.

There are approximately 2.6 million Americans who work in the insurance fields. 1.5 million work for companies, and the other 1.1 million are local insurance agents/brokers living in our communities. About 500,000 Americans are employed selling and managing health insurance plans. They work for one of the 859 health insurance companies in America.

Over 50% of the money collected from U.S. citizens in health insurance premiums by private firms goes to just 10 companies. Here they are with the premiums they collected last year: UnitedHealth Group ($67B), Anthem ($55B), Humana ($51B), HealthCare Service Corp ($33B), Aetna ($24B), Centene Corp ($20B), Independence Health Group ($14B), WellCare ($12B), Kaiser ($12B), Molina ($12B). Anthem and HealthCare Service Corp are BC/BS derivatives.

The private companies by some accounts consume at least .20 cents on every health care dollar. Roughly 50% of their spend goes to employee wages and salaries. Their back-offices from actuaries to claims processors, from marketers to strategic planners, consume much of the rest. But of course, there’s ample room for profit, as we learned last week when UnitedHealth Group CEO, Stephen J. Helmsley, reported a 35% 1st Quarter profit, largely tied to adding over 1 million Medicare and Medicaid customers in the quarter, after he stiff-shouldered ACA plans. Some of UnitedHealth Group’s profit came from their own customers. But much of it came from their role as silent partners for large self-employed corporations and the federal government. Much of the money was “passed-through” these middle men claim managers.

Consider the fact that in 2015, here was the breakdown on health care claims payments by primary source: Private Insurers (33%), Medicare (20%), Medicaid (17%), DOD-VA-CHIP (4%), Government Public Health programs (3%), Other 3rd Party Payers (8%), Self-Pay (11%). Point being that private insurers have been at the trough of public insurance for a long time.

Costs of course have been skyrocketing. Complexity and inconvenience is legendary. In one recent audit of private insurer managed Medicare Advantage plans more than 50% of denials were not accompanied by “adequate or accurate rationale”. The cost of such intentional complexity quickly multiplies through a Byzantine and financially corrosive series of feed back loops that demand ever more coders, billers and financial analysts in hospitals and doctors offices across our land. There are now 16 non-clinical health care workers for every one physician in the U.S. Administrative costs in U.S. hospitals consume 25% of their budgets compared to just 12% in Canada.

As for trust, the politics of Obamacare managed to expose a wide range of bad behavers who overplayed their hands.

1. UnitedHealth Group Inc. boldly announced their intended exit from the ACA Exchanges in 2015 in coordination with a Republican discreditation campaign to “death spiral” the program in the lead-up to the 2016 Presidential election. As they exited the admittedly challenging federal program, they made sure to be clear they were all in on the the low-hanging federal fruit like Medicare Advantage. When they pulled out of the Virginia exchanges, they boldly declared that this action “in no way impacts our small and large group businesses, or Medicare or Medicaid programs in the Commonwealth.”

2. Then there’s Aetna: Their chief executive, Mark Bertolini, loved the term “death spiral” and used it repeatedly before and after conferring with Trump in the White House. Their attempt at a megamerger with Humana was blocked on anti-trust grounds. Aetna took it to court and got a slap down from the judge who believed the company had “attempted to strong-arm the DOJ into approving the merger by threatening to exit from several insurance exchanges if the DOJ filed suit”. So much for public integrity.

Aetna has pulled out of 11 states, even though Standard & Poor’s and CBO says the exchanges will turn a profit next year. U.S. District Court Judge John D. Bates says they did it “to avoid antitrust scrutiny” and improve chances of an Aetna-Humana merger. It didn’t work.

3. Anthem, an historic BC/BS carrier, now is the second largest private health insurer in the U.S., selling exchange insurance to 839,000 members in 14 states, accounting for nearly 9% of their total revenue. It’s threat to leave Tennessee health exchanges uncovered in a third of the states counties reduced the state’s insurance regulator, Julie Mix McPeak, to begging, “The message I’m conveying is, ‘We’ll do whatever we can to make this area attractive to you on the individual exchange market,’”

4. Let’s not forget a number of truly regressive state leaders from Kansas to Oklahoma who fought Obamacare tooth and nail, and are complicit with the insurance lobby. Consider for example Oklahoma insurance commissioner, John D. Doak, the former insurance agent from Tulsa, whose red Trump-style cap reads “Make Health Insurance Great Again”, and who admits to Okie insurance agents far and wide, “I was never for Obamacare from the beginning.” Oklahoma Governor Mary Fallin, who rejected $3.6 billion in funding in 2012, apparently agrees with her northern neighbor, Gov. Sam Brownback of Kansas, that taking her state down in financial flames is the way to go. Rather than participate in the ACA and with Doak’s full-throated support, she just announced a 25% cut in the state Medicaid budget which will close multiple rural hospitals, lead to a wholesale exodus of physician providers from the state’s Medicaid programs, and leave $8.6 billion in federal dollars on the table over the next decade. Her state ranked 49 out of 50 states on the 2017 Commonwealth Fund Health Performance Scorecard.

And I could go on. This is America’s health insurance industry – a network of “non-real” jobs that add remarkable cost, but no clinical care. Let the John Doaks of the world focus on life insurance and property and casualty insurance. That’s fine. But they, and their corporate patrons and lobbyists need to get out of health care, except for supplemental policies as in Canada. We as a nation can figure out how to provide primary coverage under a single payor model. It’s not that complicated, especially if everyone is covered, there’s no cheery-picking, and we don’t have to compensate CEO’s like Helmsley and Bertolini.

Tags: aca > Aetna > Anthem > Cigna > Health Insurance > Humana > insurance industry > John D. Doak > Julie Mix McPeak > Mark Bertolini > Mary Fallin > Medicaid > Sam Brownback > Stephen Helmsley > UnitedHealth Group

Comments

2 Responses to “Non-Real Work: Eliminating Private Health Insurers From Primary Coverage. Single Payer Time Has Come.”

May 2nd, 2017 @ 11:00 am

Dr. Magee, I just posted this on my FB page. Another brilliant piece. I hope your voice is being heard by people in power. It needs to be.

May 2nd, 2017 @ 11:26 am

Many thanks, Janice. Your efforts in spreading the word are greatly appreciated. We did have over a million hits this past year. So hopefully we’re having some impact.